-

Phone:

+123 456 789 -

Email:

[email protected] -

Location:

6391 Celina, Delaware 10299

Banking Solution __

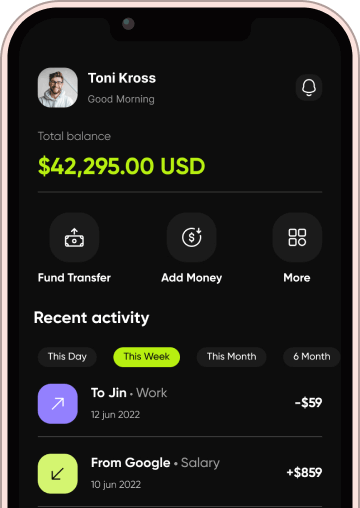

One of the biggest concerns that customers have when it comes to online banking is security.

Beyond Banking Basics: Exploring Specialized Services for High-Net-Worth Clients

north_eastBeyond Banking Basics: Exploring Specialized Services for High-Net-Worth Clients

north_eastBeyond Banking Basics: Exploring Specialized Services for High-Net-Worth Clients

north_eastBeyond Banking Basics: Exploring Specialized Services for High-Net-Worth Clients

north_eastBeyond Banking Basics: Exploring Specialized Services for High-Net-Worth Clients

north_eastIn today's digital age, customers have high expectations when it come.

In today's digital age, customers have high expectations when it come.

In today's digital age, customers have high expectations when it come.

In today's digital age, customers have high expectations when it come.

Customers

Customer satisfaction

Money managed

Credit cards typically have a credit limit, which is the maximum amount .

Credit cards typically have a credit limit, which is the maximum amount that the cardholder can borrow at any given time. The cardholder is responsible for making payments on time, and if they do not, they may incur fees or penalties, as well as damage to their credit score.

Credit cards typically have a credit limit, which is the maximum amount that the cardholder can borrow at any given time. The cardholder is responsible for making payments on time, and if they do not, they may incur fees or penalties, as well as damage to their credit score.

Credit cards typically have a credit limit, which is the maximum amount that the cardholder can borrow at any given time. The cardholder is responsible for making payments on time, and if they do not, they may incur fees or penalties, as well as damage to their credit score.

Credit cards typically have a credit limit, which is the maximum amount that the cardholder can borrow at any given time. The cardholder is responsible for making payments on time, and if they do not, they may incur fees or penalties, as well as damage to their credit score.

Credit cards typically have a credit limit, which is the maximum amount that the cardholder can borrow at any given time. The cardholder is responsible for making payments on time, and if they do not, they may incur fees or penalties, as well as damage to their credit score.

Credit cards typically have a credit limit, which is the maximum amount that the cardholder can borrow at any given time. The cardholder is responsible for making payments on time, and if they do not, they may incur fees or penalties, as well as damage to their credit score.

Credit cards typically have a credit limit, which is the maximum amount that the cardholder can borrow at any given time. The cardholder is responsible for making payments on time, and if they do not, they may incur fees or penalties, as well as damage to their credit score.

Credit cards typically have a credit limit, which is the maximum amount that the cardholder can borrow at any given time. The cardholder is responsible for making payments on time, and if they do not, they may incur fees or penalties, as well as damage to their credit score.

Credit cards typically have a credit limit, which is the maximum amount that the cardholder can borrow at any given time. The cardholder is responsible for making payments on time, and if they do not, they may incur fees or penalties, as well as damage to their credit score.

Credit cards typically have a credit limit, which is the maximum amount that the cardholder can borrow at any given time. The cardholder is responsible for making payments on time, and if they do not, they may incur fees or penalties, as well as damage to their credit score.

Credit cards typically have a credit limit, which is the maximum amount that the cardholder can borrow at any given time. The cardholder is responsible for making payments on time, and if they do not, they may incur fees or penalties, as well as damage to their credit score.

Credit cards typically have a credit limit, which is the maximum amount that the cardholder can borrow at any given time. The cardholder is responsible for making payments on time, and if they do not, they may incur fees or penalties, as well as damage to their credit score.

Credit cards typically have a credit limit, which is the maximum amount that the cardholder can borrow at any given time. The cardholder is responsible for making payments on time, and if they do not, they may incur fees or penalties, as well as damage to their credit score.

Credit cards typically have a credit limit, which is the maximum amount that the cardholder can borrow at any given time. The cardholder is responsible for making payments on time, and if they do not, they may incur fees or penalties, as well as damage to their credit score.

Credit cards typically have a credit limit, which is the maximum amount that the cardholder can borrow at any given time. The cardholder is responsible for making payments on time, and if they do not, they may incur fees or penalties, as well as damage to their credit score.

Credit cards typically have a credit limit, which is the maximum amount that the cardholder can borrow at any given time. The cardholder is responsible for making payments on time, and if they do not, they may incur fees or penalties, as well as damage to their credit score.

Credit cards typically have a credit limit, which is the maximum amount that the cardholder can borrow at any given time. The cardholder is responsible for making payments on time, and if they do not, they may incur fees or penalties, as well as damage to their credit score.

Credit cards typically have a credit limit, which is the maximum amount that the cardholder can borrow at any given time. The cardholder is responsible for making payments on time, and if they do not, they may incur fees or penalties, as well as damage to their credit score.

Credit cards typically have a credit limit, which is the maximum amount that the cardholder can borrow at any given time. The cardholder is responsible for making payments on time, and if they do not, they may incur fees or penalties, as well as damage to their credit score.

Credit cards typically have a credit limit, which is the maximum amount that the cardholder can borrow at any given time. The cardholder is responsible for making payments on time, and if they do not, they may incur fees or penalties, as well as damage to their credit score.

Banks have been around for centuries, and their role in the economy has evolved over time.

Bank

sms 06 comments

Banks have been around for centuries, and their role in evolved over time.

Bank

sms 06 comments

Banks have been around for centuries, and their role in evolved over time.

Bank

sms 06 comments

Banks have been around for centuries, and their role in evolved over time.